Recent Posts

- April, 2024

Using Data, Analytics & AI to step-change your Sustainability

Laying the foundations for a generative A.I. strategy that delivers value

Why the EU’s new Corporate Sustainability Reporting Directive (CSRD) legislation will have a major impact on the Sustainability of your business

- March, 2024

The Foundations of Effective IT Service Management with Paul Stanley

The Foundations of Effective IT Service Management with Paul Stanley

Why the EU’s new Corporate Sustainability Reporting Directive (CSRD) legislation will have a major impact on the Sustainability of your business

A Sustainability paradigm shift is underway. If you are headquartered in Europe, or have significant operations on the continent, it is going to have a highly significant effect on your strategy and operations. It is also going to have a big impact on your suppliers and partners. In fact, all stakeholders will notice a sizeable change – from your customers to your employees to the communities that are impacted by your company’s products and services.

In late 2023 the EU brought in a new sustainability regulation – the Corporate Sustainability Reporting Directive (CSRD). There is already an alphabet soup of methodologies, frameworks and regulations out there – GRI, SBTI, TCFD, ISSB, SEC, CDP, BCorp etc. So what makes this so different from the others?

The basics: the EU’s CSRD is a comprehensive, mandatory reporting legislation for large businesses operating in the EU. Around 50,000 companies across the European Union are going to be responsible for reporting against the CSRD. This directive builds on its predecessor, the Non-Financial Reporting Directive (NFRD), and aims at bolstering the visibility of corporate impacts on society and the environment. It will help investors and consumers make more sustainable choices. This will help to bring European business into alignment with the UN’s Sustainable Development Goals (SDGs). CSRD achieves this by demanding enhanced Sustainability disclosures, via more rigorous and transparent reporting guidelines.

CSRD will impact not only large companies operating in the EU. It will also impact the tens of thousands of smaller-company suppliers in their supply chains, due to the obligation to report on supply chain ‘Scope 3’ emissions and other environmental and social impacts. Due to the globalised nature of modern supply chains, those suppliers are distributed around the world. The EU are effectively using a ‘trojan horse’ strategy: while CSRD appears to focus on the sustainability of larger companies, it will in practice result in the participation of a large portion of their supply chains also.

Read on for an introduction to the main aspects of CSRD.

Reporting requirements

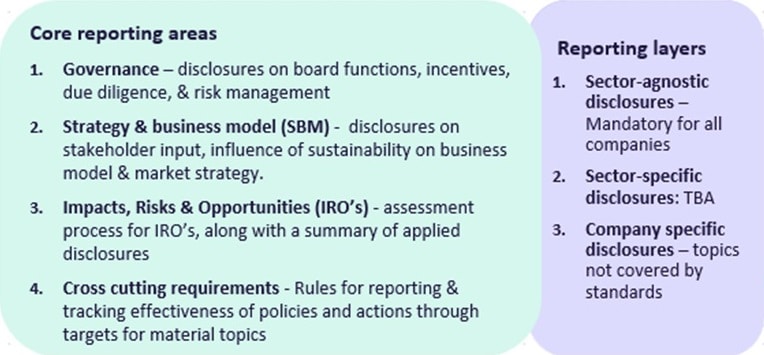

There are four core Reporting Areas that are applicable to all companies, and three Reporting Layers, including sector-specific and company-specific aspects.

Figure 1: What do companies need to disclose

The ESRS Standards

Companies must follow the European Sustainability Reporting Standards (ESRS) when carrying out their Sustainability reporting. They cover environmental, social, and governance topics.

Figure 2: The ESRS Standards

Double Materiality

Companies must analyse their sustainability impact via two different types of materiality: impact of the business on people and planet (‘Impact Materiality’), and how sustainability risks affect the business (‘Financial materiality’).

Figure 3: Double Materiality

Compliance timeline

CSRD entered into force in 2023 and will, between now and 2028, become mandatory for increasingly smaller companies.

Figure 4: Timeline for when companies must comply

Key differences between CSRD and the ‘old ESG’ reporting paradigm

The changes vs what we have seen historically when it comes to ESG reporting are highly significant.

A double materiality approach is needed; reporting is legally mandatory rather than voluntary, with reports needing to go through assurance, and with significant financial penalties applied for non-compliance; baseline metrics, action plans, KPIs and targets must be published. There is a lot of work to be done!

The table below provides an overview of the differences between CSRD and the ‘old ESG’.

Table 1: Old ESG Vs New CSRD

The impact will be highly significant for all sizes of companies that are headquartered in the EU, have a large presence in the EU, or do a lot of trade with EU-operating companies. Strategy and Operations will embrace Sustainability as a top concern, given the impact of non-compliance and raised stakeholders expectations. In turn, as discussed, transformative change will ripple through the supply chain, with the smaller companies comprising the supplier base all needing to demonstrate how they are making progress towards their sustainability targets, and the impact of sustainability risks on their bottom line. Last but not least, these changes present a major opportunity to refresh your business at every level, whether energising your employees with a new sense of purpose, or innovating new products and services to meet the needs of emerging new markets and changing customer needs.

This article was written by Marcos Moret. Thanks to Anisha Passcuran, Mohamed el Harchaoui and Shobhendra Devries for contributing.

To find out more about the extraordinary importance of Supply Chains for Sustainability, keep an eye out for our next blog post.

Get in touch with the Riverflex team to find out how we can help you become a Sustainable business.